pay indiana state sales taxes

The state sales tax on a car purchase in Indiana is 7. Local tax rates in Indiana range from 700 making the sales tax range in Indiana 700.

Indiana businesses have to pay taxes at the state and federal levels.

. For the feds youll need to register with the IRS. Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax. Claim a gambling loss on my Indiana return.

Pay an Indiana Tax return through INTIME. After your business is registered in Indiana you will. ATTENTION-- ALL businesses in Indiana must file and pay.

Make an individual return or extension payment without logging in to INTIME. This registration can be completed in INBiz. Therefore you will be required to pay an additional 7 on top of the purchase price of the vehicle.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Pay my tax bill in installments. Indiana does not have any local or county sales taxes so the state-wide rate of 700 applies to all applicable purchases to which sales tax must apply.

This makes calculation for out of state. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e. But for the Department of Revenue you can do it here.

Cookies are required to use this site. Indiana sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding.

Find your Indiana combined state and local tax rate. Lets start with simple step-by-step instructions for logging on to the website in order to file and pay your sales tax return. How to Sign-in and File a Return on Indianas Website.

Indiana levies several taxes and fees in addition to its sales tax of 7 percent including a complimentary use tax. Your browser appears to have cookies disabled. Indiana is one of.

The option to make a. Have more time to file my taxes and I think I will owe the Department. The state charges a 7 sales tax on the total car price at the.

Take the renters deduction. Groceries and prescription drugs are exempt from the Indiana sales tax. Or Completing Form ES-40 and.

County Rates Available Online-- Indiana county resident and nonresident income tax rates are available via Department Notice 1. The base state sales tax rate in Indiana is 7. Any business meeting these qualifications must register with the Department of Revenue.

Purchasers do not pay both sales and use taxes but one or the other. Note that Indiana law IC 6-25-2-1c requires a seller without a physical location in Indiana to obtain a registered retail merchants certificate collect and remit applicable sales tax if the. The Indiana state sales tax rate is 7 and the average IN sales tax after local surtaxes is 7.

Know when I will receive my tax refund. When you buy a car you have to pay Indiana sales tax on the purchase plus excise tax to register the vehicle. Find Indiana tax forms.

State Sales Taxes Could Cut Into Black Friday Savings Don T Mess With Taxes

2022 State Tax Reform State Tax Relief Rebate Checks

Indiana Sales Tax Calculator Reverse Sales Dremployee

Indiana Tax Sales Tax Liens Youtube

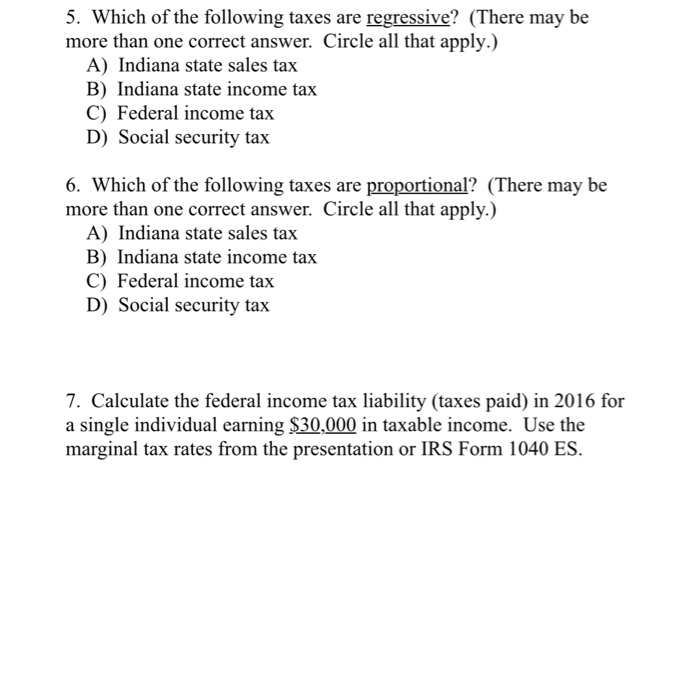

Solved 5 Which Of The Following Taxes Are Regressive Chegg Com

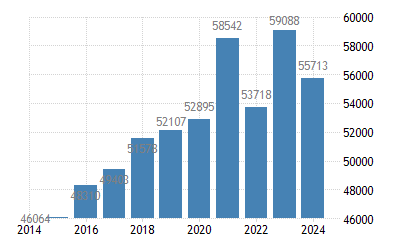

State Government Tax Collections Alcoholic Beverages Selective Sales Taxes In Indiana 2022 Data 2023 Forecast 1992 2021 Historical

Indiana Sales Tax Exemption Certificate

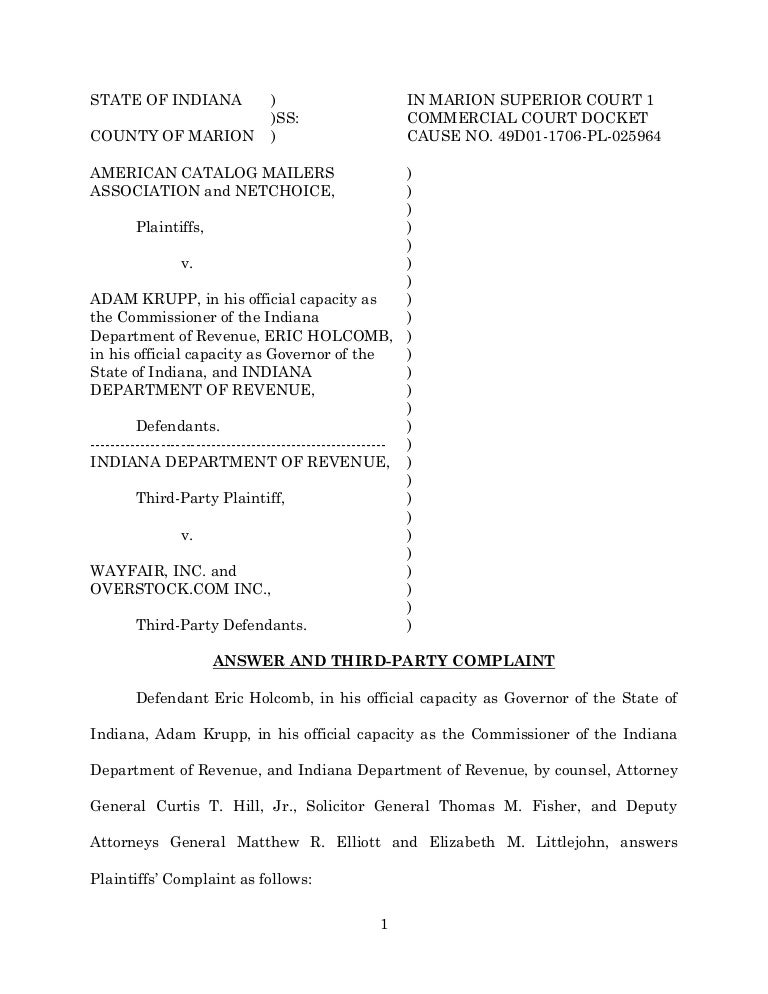

Indiana Files Online Sales Tax Suit

Does Indiana Tax Its Residents More Or Less Than Other States Carroll County Comet

Indiana Will Start Online Sales Tax Enforcement Oct 1 Eagle Country 99 3

Dor Unemployment Compensation State Taxes

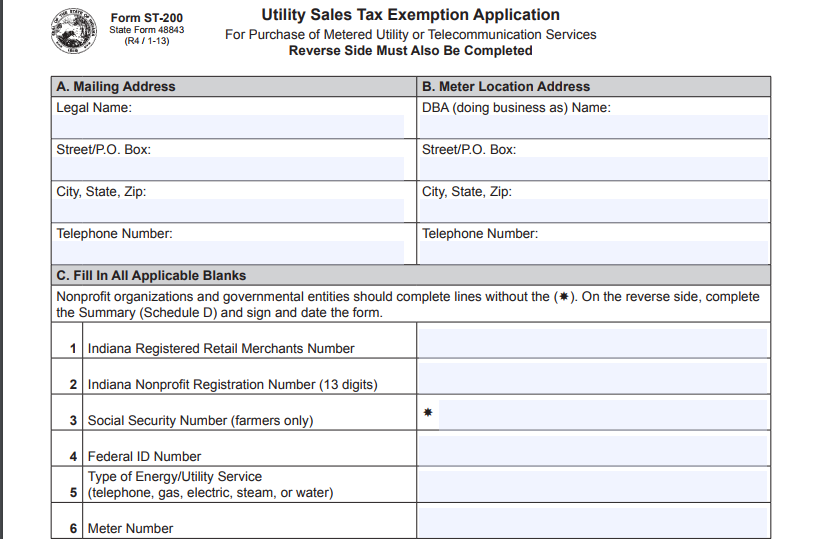

How To File For Utility Sales Tax Exemption In Indiana Blog Enguard Inc

What S The Car Sales Tax In Each State Find The Best Car Price

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com